Payments Infrastructure Platform

Designed a unified design system and an integrated suite of applications for a payments infrastructure platform for merchants. Designs improved the overall merchant experience and delivering 7 new tools within a span of a year.

Full Redesign of the platform

7 new application designs

Onboarded over 12K merchants

Client

Finix

Domain

Fintech- Payments

Deliverables

UX, UI, Design System, QA

Timeline

Q1 2021 - Q4 2021

Payments Infrastructure Platform

Designed a unified design system and an integrated suite of applications for a payments infrastructure platform for merchants. Designs improved the overall merchant experience and delivering 7 new tools within a span of a year.

Full Redesign of the platform

7 new application designs

Onboarded over 12K merchants

Client

Finix

Domain

Fintech- Payments

Deliverables

UX, UI, Design System, QA

Timeline

Q1 2021 - Q4 2021

Payments Infrastructure Platform

Designed a unified design system and an integrated suite of applications for a payments infrastructure platform for merchants. Designs improved the overall merchant experience and delivering 7 new tools within a span of a year.

Full Redesign of the platform

7 new application designs

Onboarded over 12K merchants

Client

Finix

Domain

Fintech- Payments

Deliverables

UX, UI, Design System, QA

Timeline

Q1 2021 - Q4 2021

Inconsistent UX and limited payments tooling

$ 1 Billion+

Total Payments Volume

12,000

Active merchants

1 Billion+

API Calls

Context

The payments industry is rapidly transforming as SaaS platforms, marketplaces, and e-commerce grow. Traditionally, companies had to choose between costly in-house systems or rigid third-party processors—leading to poor experiences, limited customization, and lost revenue. Finix fills this gap by providing payment infrastructure that lets merchants own their payment experience and operate as processors.

Challenge

Merchants were drowning in complex legacy payment systems, fragmented compliance tools, and rising operational costs while struggling to meet PCI, KYC, and AML requirements. Finix built a comprehensive application suite to solve these problems. Yet merchants complained of inconsistent experiences across disconnected tools, confusing workflows requiring constant app-switching, and steep learning curves for each system.

Business goals

The improved user experience directly translates to faster onboarding, higher transaction volumes, and reduced support costs, increasing ROI while enabling Finix to compete effectively against integrated solutions like Stripe and Square.

User goals

Merchants want to focus on growing their core business and control over payment processes while avoiding costly third-party dependencies and ensuring seamless compliance with PCI, KYC, and AML requirements.

Inconsistent UX and limited payments tooling

$ 1 Billion+

Total Payments Volume

12,000

Active merchants

1 Billion+

API Calls

Context

The payments industry is rapidly transforming as SaaS platforms, marketplaces, and e-commerce grow. Traditionally, companies had to choose between costly in-house systems or rigid third-party processors—leading to poor experiences, limited customization, and lost revenue. Finix fills this gap by providing payment infrastructure that lets merchants own their payment experience and operate as processors.

Challenge

Merchants were drowning in complex legacy payment systems, fragmented compliance tools, and rising operational costs while struggling to meet PCI, KYC, and AML requirements. Finix built a comprehensive application suite to solve these problems. Yet merchants complained of inconsistent experiences across disconnected tools, confusing workflows requiring constant app-switching, and steep learning curves for each system.

Business goals

The improved user experience directly translates to faster onboarding, higher transaction volumes, and reduced support costs, increasing ROI while enabling Finix to compete effectively against integrated solutions like Stripe and Square.

User goals

Merchants want to focus on growing their core business and control over payment processes while avoiding costly third-party dependencies and ensuring seamless compliance with PCI, KYC, and AML requirements.

Inconsistent UX and limited payments tooling

$ 1 Billion+

Total Payments Volume

12,000

Active merchants

1 Billion+

API Calls

Context

The payments industry is rapidly transforming as SaaS platforms, marketplaces, and e-commerce grow. Traditionally, companies had to choose between costly in-house systems or rigid third-party processors—leading to poor experiences, limited customization, and lost revenue. Finix fills this gap by providing payment infrastructure that lets merchants own their payment experience and operate as processors.

Challenge

Merchants were drowning in complex legacy payment systems, fragmented compliance tools, and rising operational costs while struggling to meet PCI, KYC, and AML requirements. Finix built a comprehensive application suite to solve these problems. Yet merchants complained of inconsistent experiences across disconnected tools, confusing workflows requiring constant app-switching, and steep learning curves for each system.

Business goals

The improved user experience directly translates to faster onboarding, higher transaction volumes, and reduced support costs, increasing ROI while enabling Finix to compete effectively against integrated solutions like Stripe and Square.

User goals

Merchants want to focus on growing their core business and control over payment processes while avoiding costly third-party dependencies and ensuring seamless compliance with PCI, KYC, and AML requirements.

Payments Platform with Advanced Tools

Operational efficiencies

Adopting a unified design system ensures that merchants can use and get access to their tools efficiently.

Machine learning and low-code tools reduces manual processes by 60%, saving money and reducing operational overhead.

Consolidated tooling reduces customer support costs by an estimated 40% as merchants experience fewer workflow bottlenecks.

New tools

Addition of 7 new tools within a 1-year timeline based on merchant feedback.

Streamlined merchant onboarding helps merchants to quickly set up their accounts and start processing payments.

Automated underwriting and the rules builder eliminate time-consuming manual processes,

Subscription billing tools enable merchants to easily set up and manage recurring payment schedules

Reusable components

Reusable components create a standardized visual and interaction framework that reduces both development effort and design time.

Ensures merchants experience consistent interfaces and workflows across the platform, creating familiarity and trust..

Component reusability allows the team to focus on building new functionality rather than recreating existing design elements.

Payments Platform with Advanced Tools

Operational efficiencies

Adopting a unified design system ensures that merchants can use and get access to their tools efficiently.

Machine learning and low-code tools reduces manual processes by 60%, saving money and reducing operational overhead.

Consolidated tooling reduces customer support costs by an estimated 40% as merchants experience fewer workflow bottlenecks.

New tools

Addition of 7 new tools within a 1-year timeline based on merchant feedback.

Streamlined merchant onboarding helps merchants to quickly set up their accounts and start processing payments.

Automated underwriting and the rules builder eliminate time-consuming manual processes,

Subscription billing tools enable merchants to easily set up and manage recurring payment schedules

Reusable components

Reusable components create a standardized visual and interaction framework that reduces both development effort and design time.

Ensures merchants experience consistent interfaces and workflows across the platform, creating familiarity and trust..

Component reusability allows the team to focus on building new functionality rather than recreating existing design elements.

Payments Platform with Advanced Tools

Operational efficiencies

Adopting a unified design system ensures that merchants can use and get access to their tools efficiently.

Machine learning and low-code tools reduces manual processes by 60%, saving money and reducing operational overhead.

Consolidated tooling reduces customer support costs by an estimated 40% as merchants experience fewer workflow bottlenecks.

New tools

Addition of 7 new tools within a 1-year timeline based on merchant feedback.

Streamlined merchant onboarding helps merchants to quickly set up their accounts and start processing payments.

Automated underwriting and the rules builder eliminate time-consuming manual processes,

Subscription billing tools enable merchants to easily set up and manage recurring payment schedules

Reusable components

Reusable components create a standardized visual and interaction framework that reduces both development effort and design time.

Ensures merchants experience consistent interfaces and workflows across the platform, creating familiarity and trust..

Component reusability allows the team to focus on building new functionality rather than recreating existing design elements.

Unified platform with new applications

Merchant onboarding

Multi-step application to onboard a new merchant onto the platform.

Email confirmation of account.

Dashboard with snapshot of activities and pending activities.

Merchant application

Gathers basic company details, ownership information, and expected transaction volumes to understand the business and its payment processing needs.

Once approved, merchants have immediate access to start processing payments.

Sandbox accounts

Merchants can test Finix's functionality and experience through sandbox accounts, allowing them to evaluate the platform's capabilities without any commitment or risk.

Merchant underwriting

Automated merchant underwriting using machine learning.

Removes manual risk assessments by auto recommending whether to approve, reject or review the application.

Processing flags

Payment processing flags automatically identify suspicious transactions based on unusual amounts, frequency, or location patterns, helping merchants prevent fraud and maintain compliance with card network rules.

Subscription billing

Merchants can easily create and modify subscription billing schedules to match their specific business needs.

The unified subscription tools enable merchants to control all automated recurring payments from a single platform.

Unified platform with new applications

Merchant onboarding

Multi-step application to onboard a new merchant onto the platform.

Email confirmation of account.

Dashboard with snapshot of activities and pending activities.

Merchant application

Gathers basic company details, ownership information, and expected transaction volumes to understand the business and its payment processing needs.

Once approved, merchants have immediate access to start processing payments.

Sandbox accounts

Merchants can test Finix's functionality and experience through sandbox accounts, allowing them to evaluate the platform's capabilities without any commitment or risk.

Merchant underwriting

Automated merchant underwriting using machine learning.

Removes manual risk assessments by auto recommending whether to approve, reject or review the application.

Processing flags

Payment processing flags automatically identify suspicious transactions based on unusual amounts, frequency, or location patterns, helping merchants prevent fraud and maintain compliance with card network rules.

Subscription billing

Merchants can easily create and modify subscription billing schedules to match their specific business needs.

The unified subscription tools enable merchants to control all automated recurring payments from a single platform.

Merchant underwriting

Automated merchant underwriting using machine learning.

Removes manual risk assessments by auto recommending whether to approve, reject or review the application.

Sandbox accounts

Merchants can test Finix's functionality and experience through sandbox accounts, allowing them to evaluate the platform's capabilities without any commitment or risk.

Unified platform with new applications

Merchant onboarding

Multi-step application to onboard a new merchant onto the platform.

Email confirmation of account.

Dashboard with snapshot of activities and pending activities.

Merchant application

Gathers basic company details, ownership information, and expected transaction volumes to understand the business and its payment processing needs.

Once approved, merchants have immediate access to start processing payments.

Processing flags

Payment processing flags automatically identify suspicious transactions based on unusual amounts, frequency, or location patterns, helping merchants prevent fraud and maintain compliance with card network rules.

Subscription billing

Merchants can easily create and modify subscription billing schedules to match their specific business needs.

The unified subscription tools enable merchants to control all automated recurring payments from a single platform.

Merchant underwriting

Automated merchant underwriting using machine learning.

Removes manual risk assessments by auto recommending whether to approve, reject or review the application.

Sandbox accounts

Merchants can test Finix's functionality and experience through sandbox accounts, allowing them to evaluate the platform's capabilities without any commitment or risk.

Ongoing Application Releases Over 1 Year

Discovery

Workflow analysis

Heuristic Reviews

Requirements gathering

Feature prioritization

Design

Wireframes

High-fidelity design

Prototypes

Presentations

Delivery

Design system

Documentation

Visual quality assurance

Ongoing Application Releases Over 1 Year

Discovery

Workflow analysis

Heuristic Reviews

Requirements gathering

Feature prioritization

Design

Wireframes

High-fidelity design

Prototypes

Presentations

Delivery

Design system

Documentation

Visual quality assurance

Ongoing Application Releases Over 1 Year

Discovery

Workflow analysis

Heuristic Reviews

Requirements gathering

Feature prioritization

Design

Wireframes

High-fidelity design

Prototypes

Presentations

Delivery

Design system

Documentation

Visual quality assurance

Heuristic Review and UX Strategy Alignment

Activities

Audit

Heuristic Reviews

Requirements gathering

Audit of previous UI screens

Audit

An audit of the existing platform UI was conducted to identify inconsistencies, usability gaps, and design discrepancies that were contributing to merchant support tickets and operational inefficiencies.

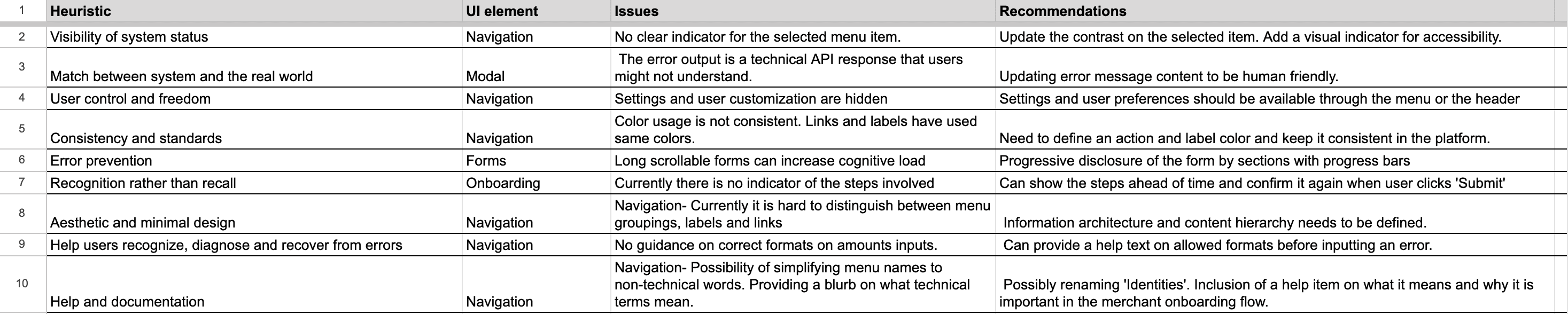

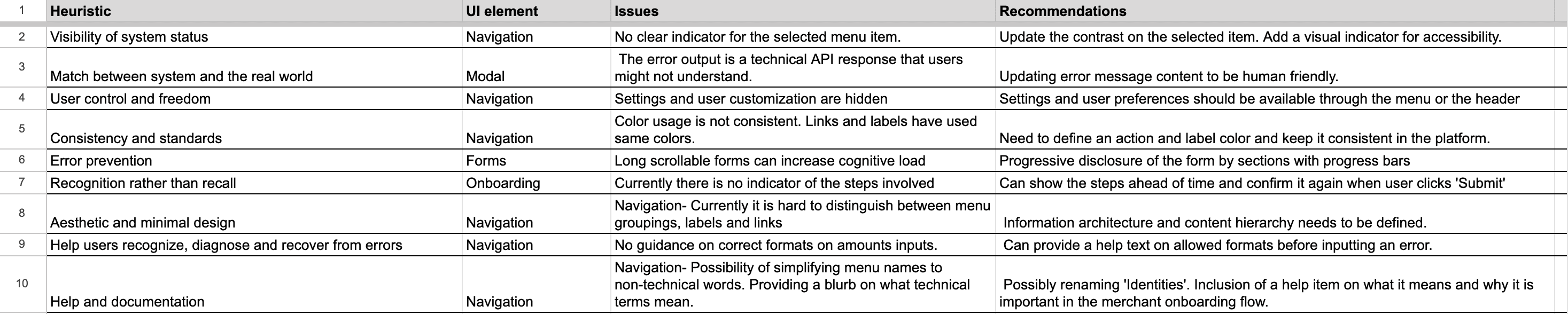

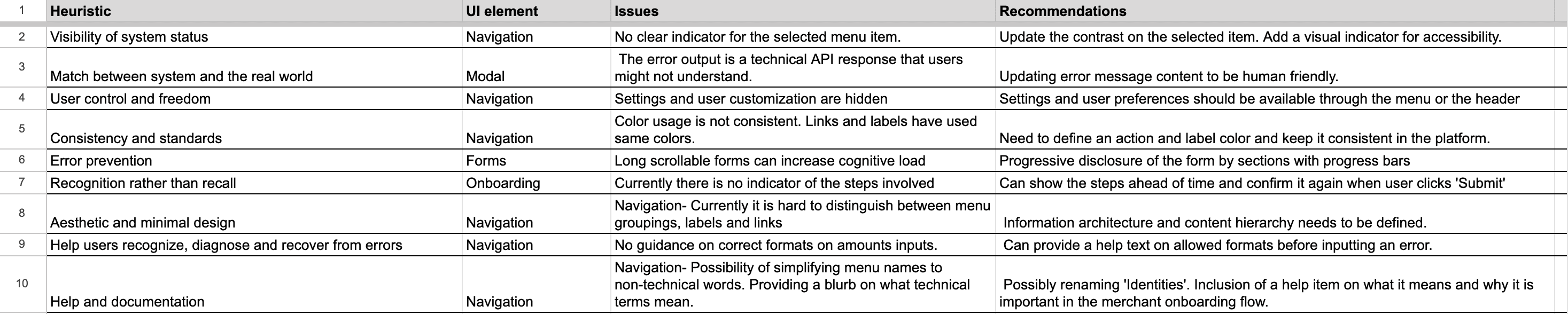

Heuristic Review

Product teams requested a full heuristic review of the entire platform to identify usability issues and improvement opportunities. I conducted the review and presented findings to Product Managers to establish alignment on UX priorities and define focused areas for strategic design improvements.

Audit of previous UI screens

"The goal of Finix is to make every business a payments infrastructure business and generate revenue by eliminating processing fees. "

-Ambar Pansari (Product Manager)

Personas

SaaS Companies

SaaS companies who needs to offer embedded payments to customers, but don't have a large developer team. They are seeking APIs that customize the payment experience and maintain control over customer relationships.

Online Marketpaces

Online marketplaces connecting buyers and sellers, that need fast merchant onboarding without sacrificing compliance. They want a reliable solution to maximize revenue from payments while keeping costs low.

Direct Merchants

Tech-forward merchants processing over $1M annually who wants to embed payments seamlessly into their customer experience. They value extensive customizations and clear error reporting with transparent pricing.

Requirements

Create a unified design system for the platform addressing difficult navigation, inconsistencies and optimizing forms.

Design updated merchant onboarding experience .

Design a demo and sandbox account for merchants.

Automated merchant underwriting and rules builder.

Frauds, disputes and processing flags.

Merchant application forms.

Subscription Billing.

Apple Pay integration.

Key Insights

Simplicity

Merchants expect an intuitive experience where they can integrate and manage payments easily

Wayfinding

A clear navigation framework and information architecture will help users navigate the platform easily.

Compliance

Payment integration must comply with strict regulatory guidelines which should be well integrated.

Heuristic Review and UX Strategy Alignment

Activities

Audit

Heuristic Reviews

Requirements gathering

Audit of previous UI screens

Audit

An audit of the existing platform UI was conducted to identify inconsistencies, usability gaps, and design discrepancies that were contributing to merchant support tickets and operational inefficiencies.

Heuristic Review

Product teams requested a full heuristic review of the entire platform to identify usability issues and improvement opportunities. I conducted the review and presented findings to Product Managers to establish alignment on UX priorities and define focused areas for strategic design improvements.

Audit of previous UI screens

"The goal of Finix is to make every business a payments infrastructure business and generate revenue by eliminating processing fees. "

-Ambar Pansari (Product Manager)

Personas

SaaS Companies

SaaS companies who needs to offer embedded payments to customers, but don't have a large developer team. They are seeking APIs that customize the payment experience and maintain control over customer relationships.

Online Marketpaces

Online marketplaces connecting buyers and sellers, that need fast merchant onboarding without sacrificing compliance. They want a reliable solution to maximize revenue from payments while keeping costs low.

Direct Merchants

Tech-forward merchants processing over $1M annually who wants to embed payments seamlessly into their customer experience. They value extensive customizations and clear error reporting with transparent pricing.

Requirements

Create a unified design system for the platform addressing difficult navigation, inconsistencies and optimizing forms.

Design updated merchant onboarding experience .

Design a demo and sandbox account for merchants.

Automated merchant underwriting and rules builder.

Frauds, disputes and processing flags.

Merchant application forms.

Subscription Billing.

Apple Pay integration.

Key Insights

Simplicity

Merchants expect an intuitive experience where they can integrate and manage payments easily

Wayfinding

A clear navigation framework and information architecture will help users navigate the platform easily.

Compliance

Payment integration must comply with strict regulatory guidelines which should be well integrated.

Heuristic Review and UX Strategy Alignment

Activities

Audit

Heuristic Reviews

Requirements gathering

Audit of previous UI screens

Audit

An audit of the existing platform UI was conducted to identify inconsistencies, usability gaps, and design discrepancies that were contributing to merchant support tickets and operational inefficiencies.

Heuristic Review

Product teams requested a full heuristic review of the entire platform to identify usability issues and improvement opportunities. I conducted the review and presented findings to Product Managers to establish alignment on UX priorities and define focused areas for strategic design improvements.

Audit of previous UI screens

"The goal of Finix is to make every business a payments infrastructure business and generate revenue by eliminating processing fees. "

-Ambar Pansari (Product Manager)

Personas

SaaS Companies

SaaS companies who needs to offer embedded payments to customers, but don't have a large developer team. They are seeking APIs that customize the payment experience and maintain control over customer relationships.

Online Marketpaces

Online marketplaces connecting buyers and sellers, that need fast merchant onboarding without sacrificing compliance. They want a reliable solution to maximize revenue from payments while keeping costs low.

Direct Merchants

Tech-forward merchants processing over $1M annually who wants to embed payments seamlessly into their customer experience. They value extensive customizations and clear error reporting with transparent pricing.

Requirements

Create a unified design system for the platform addressing difficult navigation, inconsistencies and optimizing forms.

Design updated merchant onboarding experience .

Design a demo and sandbox account for merchants.

Automated merchant underwriting and rules builder.

Frauds, disputes and processing flags.

Merchant application forms.

Subscription Billing.

Apple Pay integration.

Key Insights

Simplicity

Merchants expect an intuitive experience where they can integrate and manage payments easily

Wayfinding

A clear navigation framework and information architecture will help users navigate the platform easily.

Compliance

Payment integration must comply with strict regulatory guidelines which should be well integrated.

New Applications on a Unified Design System

Activities

Wireframes

Mockups

Prototypes

Presentations

Wireframe: Create Merchant identity workflows

Wireframes

Quick wireframes enabled rapid iteration and early feedback collection from Product Managers on multiple application initiatives.

High-fidelity designs

Wireframes and content variations were developed for each application outcome and channel, then reviewed with Product Managers to gather feedback and drive iterative improvements to layout and messaging.

High fidelity mockup- Merchant identity

End-to-end merchant application prototype

Prototypes

Approved designs were developed into interactive prototypes that demonstrated complete user workflows and functionality, allowing Product teams to experience the full merchant journey and provide comprehensive feedback on the proposed solutions before development began.

New Applications on a Unified Design System

Activities

Wireframes

Mockups

Prototypes

Presentations

Wireframe: Create Merchant identity workflows

Wireframes

Quick wireframes enabled rapid iteration and early feedback collection from Product Managers on multiple application initiatives.

High-fidelity designs

Wireframes and content variations were developed for each application outcome and channel, then reviewed with Product Managers to gather feedback and drive iterative improvements to layout and messaging.

High fidelity mockup- Merchant identity

End-to-end merchant application prototype

Prototypes

Approved designs were developed into interactive prototypes that demonstrated complete user workflows and functionality, allowing Product teams to experience the full merchant journey and provide comprehensive feedback on the proposed solutions before development began.

New Applications on a Unified Design System

Activities

Wireframes

Mockups

Prototypes

Presentations

Wireframe: Create Merchant identity workflows

Wireframes

Quick wireframes enabled rapid iteration and early feedback collection from Product Managers on multiple application initiatives.

High-fidelity designs

Wireframes and content variations were developed for each application outcome and channel, then reviewed with Product Managers to gather feedback and drive iterative improvements to layout and messaging.

High fidelity mockup- Merchant identity

End-to-end merchant application prototype

Prototypes

Approved designs were developed into interactive prototypes that demonstrated complete user workflows and functionality, allowing Product teams to experience the full merchant journey and provide comprehensive feedback on the proposed solutions before development began.

Design System Assets and Development

Activities

Design system assets

Visual quality assurance

UI modernization

Layout grids used for the design system

Foundations

Established a unified design system starting with foundational elements including a cohesive color palette, standardized typography hierarchy, consistent spacing values, and flexible layout grids that would serve as the building blocks for all platform interfaces.

Reusable components

Consistent interface elements like buttons, forms, navigation menus, and data tables that can be used across all platform features, ensuring uniform functionality and appearance throughout the merchant experience.

Table component

Navigation component

Development

Figma components were systematically documented and handed off to developers with detailed specifications including spacing, states, interactions, and responsive behavior to ensure accurate implementation of the design system into functional, reusable code components.

Reference

Design System Assets and Development

Activities

Design system assets

Visual quality assurance

UI modernization

Layout grids used for the design system

Foundations

Established a unified design system starting with foundational elements including a cohesive color palette, standardized typography hierarchy, consistent spacing values, and flexible layout grids that would serve as the building blocks for all platform interfaces.

Reusable components

Consistent interface elements like buttons, forms, navigation menus, and data tables that can be used across all platform features, ensuring uniform functionality and appearance throughout the merchant experience.

Table component

Navigation component

Development

Figma components were systematically documented and handed off to developers with detailed specifications including spacing, states, interactions, and responsive behavior to ensure accurate implementation of the design system into functional, reusable code components.

Reference

Design System Assets and Development

Activities

Design system assets

Visual quality assurance

UI modernization

Layout grids used for the design system

Foundations

Established a unified design system starting with foundational elements including a cohesive color palette, standardized typography hierarchy, consistent spacing values, and flexible layout grids that would serve as the building blocks for all platform interfaces.

Reusable components

Consistent interface elements like buttons, forms, navigation menus, and data tables that can be used across all platform features, ensuring uniform functionality and appearance throughout the merchant experience.

Table component

Navigation component

Development

Figma components were systematically documented and handed off to developers with detailed specifications including spacing, states, interactions, and responsive behavior to ensure accurate implementation of the design system into functional, reusable code components.